Yesterday, Senate Minority Leader Mitch McConnell of Kentucky came up with a way to avoid the prospective government default should Congress and the White House prove unable to achieve a grand bargain on the budget. His proposal was immediately attacked by some fellow conservatives and this opens what is easily the most interesting divide within today’s Republican Party between the economic ideologues and big business Republicans.

McConnell’s proposal is an example of casuistry that would make a 17th century Jesuit proud. Instead of Congress voting to raise the debt ceiling, they would give the President the power to do so unilaterally, with the provision that the President submit to Congress a request for the increase, accompanied by budget cuts equal to the amount of the debt increase. Congress, at least the GOP-led House, would of course pass the foreseen “resolution of disapproval,” denying the President’s request to raise the debt ceiling but, because the question is put negatively, Obama could veto the measure, Congress would lack the votes to override the veto, and the debt ceiling would rise. As I say, casuistry at its best, and I intend that as a great compliment: Casuistry got a bad name but it is a good thing when done in moderation.

To be sure, McConnell’s proposal will not gain him a prominent place in some future version of the “Profiles of Courage.” But, McConnell’s proposal was designed not only to suggest a way out of the impasse in current negotiations. It was an effort to shift the debate away from the dangerous question of “if” the debt ceiling will be raised to “how” the debt ceiling will be raised. Remember, there are some prominent voices on the right saying that there is no need to raise the debt ceiling, that an immediate curtailment of 40% of government spending is just what the country needs, that things may have to get worse before they get better. There is more than a little cruelty in that last observation because those who voice it do not contemplate things getting worse for them, just worse for other people. McConnell marginalized those “default-deniers” in an instant.

McConnell’s proposal also was directed at the markets. He knows they are getting skittish about the approaching deadline and the apparent unwillingness of the House GOP to come to any sort of compromise. Indeed, McConnell may represent the great Commonwealth of Kentucky but he is also the Senate’s main representative of Big Business. He works with businessmen, not analysts at the CATO Institute. He is an old-style, big business Republican not a fanatic devotee of Austrian School of economics. McConnell, you will recall, was reluctant to endorse the ban on earmarks. McConnell is in no rush to revise the tax code which has plenty of perks for his friends. He does not want a showdown over the debt ceiling, still less a meltdown if the deadline is not met. McConnell, for all my disagreements with his positions, is a grown up who understands that governance comes with certain responsibilities, and one of those responsibilities is to find a way to get this thing done.

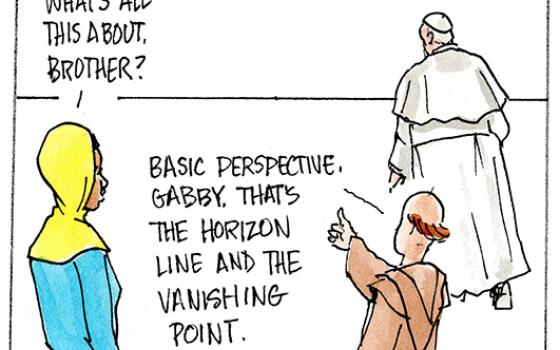

The Tea Partyers, however, have long put ideological fealty above governing responsibilities. They see the debt ceiling vote as a chance for the House GOP to exercise all the leverage it gained last year and they do not care if Humpty-Dumpty falls off the wall. Over at the website RedState.com, Erick Erickson called the McConnell proposal “the Pontius Pilate Pass the Buck Act of 2011.” House Republicans voiced profound skepticism. They have been vowing for months to use the debt ceiling vote to radically reduce the size of government and they will not easily be appeased.

Here, then, is an interesting conundrum for the GOP. Will they be the party of big business or the party of the Austrian School of economics? Business has the most to lose from an economic catastrophe of the kind a government default would produce. They want a resolution to the stand-off. “The business community in large numbers is saying to our leaders in Washington, ‘Do you job,’” Business Roundtable President John Engler, former governor of Michigan, and a Republican, told t he Washington Post. “Failure to raise the debt ceiling would strike an immediate and serious blow to any economic recovery, and failure to make significant progress on long-term debt reduction will continue the uncertainty which is hampering our investment climate.” Notice what Engler did not say. He did not say that raising taxes would constitute “an immediate and serious blow to any economic recovery.” He did not rule out anything. Alas, Engler comes from an earlier generation of Republican leaders.

The Tea Partyers will have none of it. They believe they were sent to Washington to shrink the government, even though every poll taken during last year’s election, and every poll since, indicates that the American people are much more worried about jobs than they are about long-term debt reduction. Of course, the long-term debt is a real problem. The beauty of McConnell’s proposal is that it devises a way to raise the debt ceiling and will allow the voters in 2012 to decide whether they want to pursue the risky Austrian way, or to raise taxes on the wealthy, in order to close the long-term debt.

But, we don’t have to wait until 2012 to discern what business wants. If the House GOP continues to stonewall, look for their corporate donors to look elsewhere. The election may be a year away, but the time to raise campaign cash is upon us. A few Tea Party stars may be able to generate large sums of campaign cash from small Tea Party donors nationwide, but it is unlikely all the back-benchers will have access to that money. Corporations can vote with their cash. You can bet that Mr. Engler and Minority Leader McConnell will be making that point in closed-door sessions.