A Citibank location in Midtown Manhattan, New York (Wikimedia Commons/Tdorante10)

A congregation of Catholic sisters is facing a financial showdown with Citigroup, alleging the global bank is misrepresenting a shareholder resolution that calls for a reassessment of its project-financing screens on Indigenous rights and climate change after Citigroup provided billions of dollars to a major oil company with a lengthy track record of spills.

The shareholder resolution, introduced by the Sisters of St. Joseph of Peace alongside other Catholic congregations, will be put to a vote April 25 during the annual shareholder meeting for Citigroup, one of the leading global banks with operations in more than 150 countries. The resolution requests that Citigroup produce a report evaluating the effectiveness of its policies and practices in adhering to international standards for Indigenous rights and financial industry benchmarks it helped draft for assessing environmental and social risks in project funding.

At the center of the shareholder resolution is $5 billion in financing Citigroup has provided to Enbridge, a Calgary-based fossil fuel company and one of the world’s largest pipeline builders. Replacement projects for its Line 3 and Line 5 tar sands pipelines in the upper Midwest have drawn immense scrutiny in recent years from Indigenous peoples, environmental activists and some government officials. Critics say the projects endanger Indigenous and public lands and waters.

In 2021, faith groups joined Indigenous "water protectors" in protesting Line 3 in northern Minnesota, where the pipeline's path was set to cross 200-plus water bodies, including wetlands considered sacred by the local Anishinaabe and critical for growing manoomin, or wild rice. The Line 3 replacement went into operation in October 2021.

A year earlier, Michigan Gov. Gretchen Whitmer ordered the Line 5 pipeline shut down for environmental violations. That triggered a flurry of lawsuits, which remain pending.

Opponents of Line 5, including the state's 12 federally recognized tribal nations, say the pipeline, which is past its 50-year lifespan, is no longer safe, threatens water supplies as it travels under the Great Lakes, and is incompatible with meeting national targets to limit adverse impacts of climate change.

Advertisement

The shareholder resolution also cites upward of $40 billion in financing from 2016 to 2020 by Citigroup for other pipeline projects in the Amazon Basin, one of the planet's most critical ecosystems and a key biome for mitigating heat-trapping greenhouse gas emissions that are driving climate change.

"Citigroup faces reputational risk if its 'climate forward' commitments are discredited by its own financing activities," as well as civil and criminal liability for possible Indigenous rights violations, the resolution states.

Citigroup has opposed the shareholder resolution, saying in its 2023 proxy statement that it did not provide project-specific financing for the Line 3 and Line 5 pipelines, and that the $5 billion to Enbridge was through general corporate purposes financing.

The bank added it believes its current environmental and social risk management policy is sufficient in identifying potential risks to Indigenous communities and biodiverse areas.

In response, the Sisters of St. Joseph of Peace in a filing with the Securities and Exchange Commission alleged that Citigroup "misinterprets" the resolution. The filing said Citigroup sought to "minimize its role in enabling these projects" by attempting to distance the bank from the Line 3 and Line 5 pipelines.

The sisters also contend the bank's Enterprise Security Risk Management policy lacks a formal commitment to the principle of free, prior and informed consent, which they say "is vital to implementing effective and meaningful risk management systems related to Indigenous Rights."

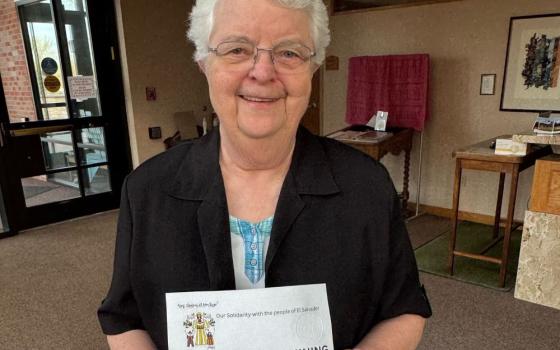

"We feel very clear and confident that if Enbridge did not have the $5 billion in general financing from Citigroup, then they would have had to apply for project financing," Sr. Susan Francois, assistant congregation leader and treasurer for the Sisters of St. Joseph of Peace, told EarthBeat.

Tara Houska, founder of the Giniw Collective that led opposition against the Enbridge pipelines, added in a statement, "When you lend [$5 billion] to Enbridge, one of the biggest oil pipeline companies in the world, it's not rocket science to figure out where the money is going."

A "Protect Our Water No Line 3 + No Pesticides" sign protests Enbridge's Line 3 oil pipeline in Palisade, Minnesota, Dec. 28, 2020. (Wikimedia Commons/Lorie Shaull)

The Sisters of St. Joseph of Peace filed the shareholder resolution along with the Sisters of St. Dominic of Caldwell, New Jersey; the Sisters of St. Francis of Philadelphia; and United Church Funds, the institutional investment ministry of the United Church of Christ. The women religious congregations are part of Investor Advocates for Social Justice, a coalition of predominantly Catholic congregations that was originally founded in 1975 as the Tri-State Coalition for Responsible Investing as part of the movement to end apartheid in South Africa.

Francois said the congregation, active in shareholder advocacy since the 1990s, has been further motivated to live out its values in economic spaces by Pope Francis and his 2015 encyclical, "Laudato Si', on Care for Our Common Home." That has included participation in the Vatican's Laudato Si' Action Platform, which has ecological economics as one of its seven emphasis areas.

"This particular resolution seems completely in line with the cry of the Earth and the cry of the poor," she said, referencing a regularly cited passage from Laudato Si'.

Francois added that if Citigroup, which was also a major funder of the Dakota Access Pipeline, had utilized its project-financing screens for Indigenous rights on the Enbridge pipeline projects, it would have found numerous violations. She pointed to Enbridge's history of oil spills (more than 800 in the past 15 years, including two of the largest inland oil spills in U.S. history), accusations the company did not have legal rights to operate on Indigenous lands, and $2 million that Enbridge reimbursed to U.S. law enforcement during the Line 3 protests that critics have said violated constitutional rights.

"Any person looking would see a human rights violation of those who are just simply seeking to protect the waters and protect their land," Francois told EarthBeat.

This is the second time the resolution has been brought against Citigroup. Last year, one also brought by Catholic congregations garnered 33% support from shareholders, which was enough to initiate a dialogue between the bank and representatives for Investor Advocates for Social Justice and First Peoples Worldwide.

But those talks broke down, Francois said, over a disagreement whether the screenings used for project financing should also apply to general financing as well.

The Enbridge Line 3 oil pipeline construction is seen from County Road 48 near Portage Lake in Todd Township, Hubbard County, Minnesota, June 11, 2021. (Flickr/Tony Webster)

The St. Joseph Sisters of Peace are hoping for even more support for the resolution this time around. While shareholder resolutions are nonbinding, companies typically respond when a measure garners more than 20% support.

The latest effort has drawn increased attention, with coverage already by the Financial Times and French television, while climate activist Bill McKibben also highlighted it in a recent newsletter.

Francois said a good outcome would even be Citigroup agreeing to return to the table in dialogue.

"We're not saying you can't fund projects, even though ultimately I think we need to look at oil extraction and the climate crisis," she said. "But what this resolution is just looking for is transparency and following the policies of Citigroup itself."

In January 2022, Citi issued a plan to reach net-zero emissions in its financing activities by 2050, and within its own operations by 2030. In a March report on its climate-related financial disclosures, Citi CEO Jane Fraser expressed the "need to invest heavily to scale new sustainable technologies and their supporting infrastructures to be viable alternatives to fossil fuels"

But she added that the transition to clean energy will take time as the global economy continues to be powered by fossil fuels and many developing countries lack the infrastructure and resources for a quick shift to renewables.

"These considerations — the energy transition, energy security and access to energy — are not mutually exclusive and must be solved for simultaneously," Fraser said.

The latest report from the United Nations' top climate science group, the Intergovernmental Panel on Climate Change, reiterated that meeting the Paris Agreement goal of limiting average global temperature rise to 1.5 degrees Celsius will require countries to slash emissions by at least 43% below 2005 levels in the next seven years, and reach net-zero by midcentury.

A separate report from the International Energy Agency, issued in May 2021, stated that financing and developing new fossil fuel projects must end immediately in order to achieve the 1.5 C target.

'Doing things like this — giving operation funding to pipeline companies — does not seem in the spirit of that net-zero goal by 2050," Francois said of Citi's financing to fossil fuel companies like Enbridge. "2050 is not that far away."

In 2022, the Sisters of St. Joseph of Peace divested their own financial holdings from the fossil fuel industry. Their work through the Laudato Si' Action Platform on ecological economics has centered in three areas: philanthropy, impact investing and shareholder advocacy.

Catholic institutions have brought forward other shareholder resolutions as well. The Sisters of St. Francis of Dubuque, Iowa, have sought for Wells Fargo to produce an annual report detailing how its lobbying activities align with its public commitments to net-zero emissions by 2050. And Fr. Edu Gariguez, a priest in the Philippines, plans to confront Barclays, Standard Charter and HSBC in the United Kingdom during their annual meetings in May over funding of companies involved in gas projects that are destroying pristine ecosystems.

"I think shareholders know that good business requires us to be open and to be honest, and we fully believe that caring for the Earth and respecting people is good business," Francois said. "So we're hopeful that other shareholders [with Citigroup] will feel that way as well. And if not, we'll be back next year."