This undated photo of an empty church in one of the nation's mission dioceses symbolizes how hard church closures are hitting parishes in these dioceses due to the coronavirus, says Catholic Extension. The national mission organization, based in Chicago, launched a virtual collection basket online March 27, to help these parishes. (CNS/Courtesy of Catholic Extension)

Days before Easter Sunday, the worries for Fr. James Olson ranged from the momentous to the mundane.

At one end, he grappled with the spiritual loss of a Holy Week in isolation, with empty pews in the four churches he pastors in northeast Philadelphia. At the other, he regretted not getting his hair cut before barbershops and other businesses shut down in response to the coronavirus pandemic.

But just behind the spiritual loss was the state of the parish finances.

Like many churches, the Easter collection is a major source of funding for St. John Paul II Parish, a cluster of four churches in the working-class neighborhood of Olde Richmond. The Easter collection from Sunday was down 75% from last year. Collections overall have declined to just a fraction of typical giving in the weeks since stay-at-home orders have prohibited public liturgies, and many parents have been laid off or furloughed.

The tight financial situation led Olson the day before Holy Thursday to file a loan application for the parish to tap into the $349 billion program Congress established to help small businesses survive a period of unprecedented economic uncertainty. "Pretty much as important as oxygen," the priest said of the federal financial assistance.

"We absolutely, positively need it," Olson said. "Our collections right now are at about 10% of normal. And normally we just scrape by."

Parishes and Catholic organizations have been among the hundreds of thousands of small businesses and nonprofits that have rushed to the Small Business Administration's Paycheck Protection Program. The emergency fund is one of the centerpieces of the Coronavirus Aid, Relief and Economic Security or CARES Act, the $2 trillion relief package passed by Congress last month to help the country withstand the economic fallout of the novel coronavirus outbreak, as millions of Americans have filed for unemployment in less than a month.

The Paycheck Protection Program offers a loan up to $10 million to businesses and nonprofit organizations with no more than 500 employees to retain their workers and cover eight weeks of payroll costs. If at least 75% of the funds are used to retain and rehire employees to February levels, the loan essentially converts to a grant, meaning no payback is required. Otherwise, loans must be repaid over two years at a 1% interest rate. The loans are available on a first-come, first-served basis, with a deadline of June 30.

As of Tuesday, the Small Business Administration had approved more than 1 million applications totaling $247 billion, according to Axios, though it wasn't known how much of that money had been transferrred into bank accounts.

At the time the bill was signed into law, it wasn't clear whether religious and other nonprofit organizations would qualify for the Paycheck Protection Program. The Small Business Administration clarified April 4, a day after the program went into effect, that all faith-based organizations that meet the eligibility criteria could receive the payroll loans, as well as a separate emergency loan program that provides advances up to $10,000.

Since the CARES Act was finalized, the Center for Church Management at Villanova University has held webinars and worked with parishes and other Catholic groups to understand the SBA program. Matthew Manion, its faculty director, said the most important thing to understand is that they're eligible. The program issues loans based on employer identification numbers, meaning a parish where the school and church have separate numbers can each apply.

The present economic situation has hit parishes especially hard, as unemployment has skyrocketed and the absence of people in the pews removing a vital financial stream to support staff and ministries. Manion estimated the weekly collection for a typical parish can cover upwards of 80% of a parish's operating budget, with the bulk spent on personnel.

"It's a huge opportunity to keep people employed at a very tenuous time," he said of the paycheck program.

In many dioceses, chanceries are coordinating the loan application process for their parishes, schools and other ministries.

This illustration depicts money going into a collection basket. With canceled Masses and limited offertories amid the coronavirus pandemic, U.S. church leaders are predicting an income squeeze that will affect parishes, dioceses and national collections. (CNS illustration/Emily Thompson)

Pat Markey, executive director of the Diocesan Fiscal Management Conference, an association of diocesan financial officers, told NCR he anticipates a large number of Catholic parishes, school and organizations will apply for the loans. A survey taken April 6 indicated around 15% of dioceses had some institution that applied, a total Markey expected to increase. He said the funds will help institutions not only keep their employees, but continue important church ministries at a critical time for many people.

With funds through the payroll program limited, both the DFMC and Center for Church Management advise Catholic institutions to carefully weigh their need before accepting the loan.

"There's a social justice question here, too. So if you need it, fine, utilize it," Markey said. "And that's the message I think all of our churches need to follow, because someone else may need it more."

In the month following lockdown measures across much of the country, more than 17 million Americans filed for unemployment as businesses laid off and furloughed workers. That has included Catholic organizations.

Catholic Charities of Eastern Washington laid off 41 employees. More than a dozen workers were furloughed at a church in Pasadena, California. An independent network of Catholic schools in Philadelphia, which operates separately from the archdiocese, let go 180 teachers and staff. Elsewhere in Pennsylvania, 30 employees were given layoffs in the Allentown Diocese, and the Pittsburgh Diocese permanently terminated all 11 employees at its diocesan newspaper along with shuttering the publication.

While Olson has avoided layoffs at both the parish and school, which together employ 55 people, the school had to furlough its hourly workers.

"This is the worst possible time for somebody who's working for the church, and who doesn't make a lot of money to begin with, to say, 'Well, you're out.' So I've been trying to pay them, but I'm really running on fumes, and I can't do it much longer," the priest said.

The parish and the school applied separately for the SBA loans with a local bank that's worked with them in the past. The school received notice April 8 its application was approved. That has relived some of the worries, but not all of them.

"Until somebody cuts a check, I probably won't be comfortable," Olson said.

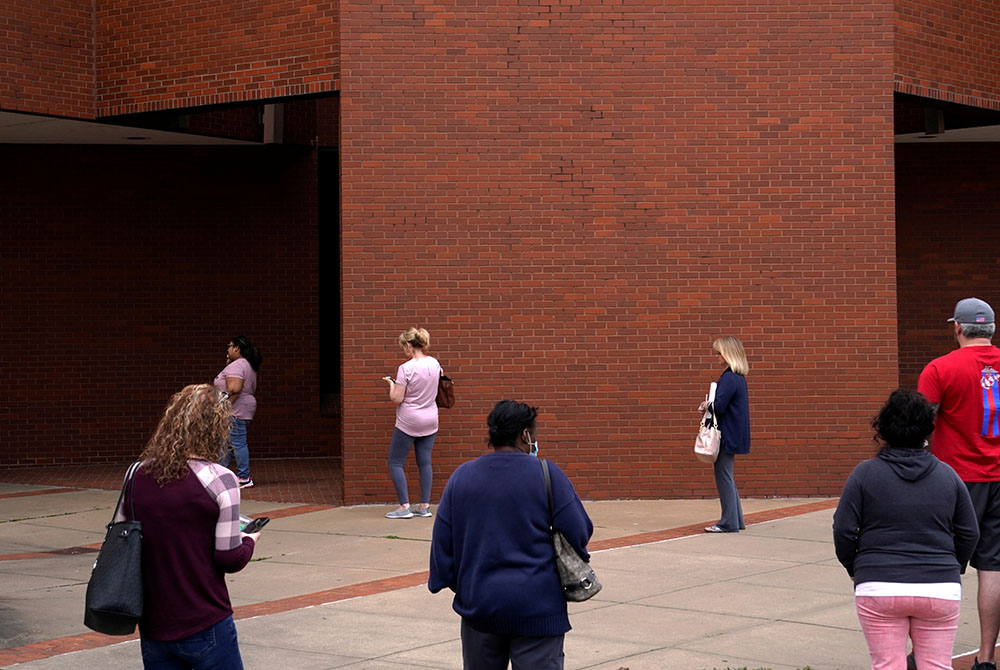

People in Fort Smith, Oklahoma, wait in line to file for unemployment April 6, 2020, during the coronavirus pandemic. (CNS/Nick Oxford, Reuters)

Since its rollout, reports have described the paycheck protection program as overwhelmed and possibly underfunded.

Within the program's first few days, major banks were flooded with hundreds of thousands of applications. By morning on April 6, Bank of America received more than 200,000 applications seeking $36 billion, and Wells Fargo reached the $10 billion cap it placed on the loan program. The Washington Post reported April 8 that a high-level official with the Small Business Administration lashed out on a teleconference at big banks "that had no problem taking billions of dollars of free money as bailout in 2008 are now the biggest banks that are resistant to helping small businesses."

Congressional lawmakers and Treasury Secretary Steve Mnuchin have called for a second round of funding. An effort to supplement the program with $250 billion fell short Thursday in the U.S. Senate, as Democrats said the unanimous consent request was put forward without negotiations.

The program itself has faced other complications. Small businesses have complained of delayed responses and that some large banks had denied applications as they prioritized larger or existing clients. Markey said that a survey April 6 of diocesan CFOs highlighted some of the early roadblocks Catholic institutions encountered, such as banks requiring a prior history or having a debt relationship — something few parishes have — or some of the first organizations to apply being told they weren't eligible.

Markey attributed part of the early issues with confusion with the rollout and the guidelines around religious and nonprofit organizations.

In some cases, troubles with bigger banks have led dioceses to pursue alternatives. At least nine dioceses have worked on loans with Notre Dame Federal Credit Union, the nation's largest Catholic credit union, which has branches in Indiana and Arizona. They include the Archdiocese of Denver and the Dioceses of Austin, San Diego, Phoenix, Sacramento, Gary, Indiana and Lansing, Michigan. Another four dioceses are on a waiting list.

As of April 13, the credit union was in the process of funding 214 loans totaling more than $60 million for Catholic parishes and organizations.

Tom Gryp, president of Notre Dame Federal Credit Union, said they've "totally shifted" their operations to help church organizations with the Paycheck Protection Program. The credit union hasn't set a hard cap for the program, but he said their size will limit how much they can lend.

As a lender, Notre Dame Credit Union has focused on making sure documentation from parishes follows SBA guidelines to ensure the loans can be fully forgiven. Gryp said he couldn't recall a period where so many were in need of emergency loans. "This is unprecedented in our society. Nobody has experienced this before."

At Mary, Mother of Mercy Parish, in Glassboro, New Jersey, pastoral associate Meryl Cerana filed the loan application Wednesday with their local bank. The whole process took her about two to three hours. Gathering the necessary payroll and benefits paperwork for the parish's 12 employees proved the biggest challenge.

As of Monday, Mother of Mercy had not heard whether the loan was approved. The parish has built up savings through a fund with the Camden Diocese and a recent capital campaign. The finance council decided to apply for the loan because of uncertainty with how long churches will remain closed or a recession may last.

The Sunday collection accounts for roughly 85% of the parish's funds.

(Unsplash/Anna Earl)

Once it became clear that churches nationwide would have to temporarily close, the Diocesan Fiscal Management Conference began attempting to determine the financial impact. "In some places, it can be rather devastating," Markey said, adding that one bishop had said offertory had declined in more well-off parishes by half and had dropped to less than a fifth in poorer areas.

The diocesan financial conference has worked to connect dioceses with companies that can set up online donations. In Boston, the archdiocese launched a three-month digital campaign to encourage financial support for its parishes. Manion at Villanova expects that the pandemic will accelerate the transition for churches to online giving.

Online donations had already begun at Mother of Mercy, but it has not kept pace with normal giving, generating an average of $4,000 in the weeks since Masses have stopped. The state of the Easter collection won't be known until midweek, but Cerana anticipates "it won't be anywhere near regular," which in past years the two envelopes for the day have nearly tripled a typical week.

"That's a huge hit for us," Cerana said.

It was the same case for St. John Paul II Parish, which relies "almost entirely" on the offertory to cover costs, said its pastor Olson. The parish, too, encourages online giving but so far that hasn't been able to make up for the lack of Sunday envelopes. For now, he'll keep checking to see if the federal funds arrive in the parish bank account.

"It will at least allow us to pay the teachers. It will at least allow me to keep people employed," the priest said. "And then keep things percolating until, God willing, this is over soon."

[Brian Roewe is an NCR staff writer. His email address is broewe@ncronline.org. Follow him on Twitter: @BrianRoewe.]

Advertisement