Amid a storm of foreclosures and other housing woes, a cross-country bus named the "Recovery Express" left Antioch, Calif., on March 6 for Washington, arriving four days later. On board were more than 50 Californians at risk of foreclosure or who had lost their homes, part of a national campaign by PICO National Network (People Improving Communities through Organizing) to stop preventable foreclosures across the nation.

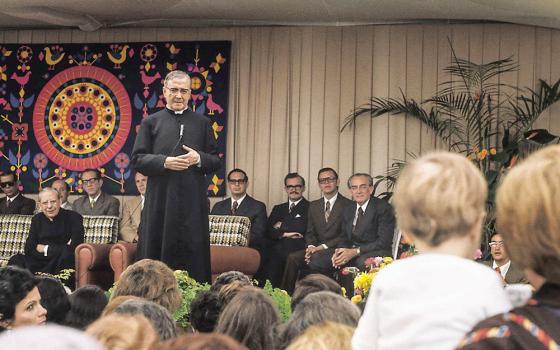

PICO, headquartered in Oakland, Calif., is a network of faith-based organizations founded in 1972 by Jesuit Fr. John Baumann.

Banks are foreclosing on U.S. homes at a rate of approximately 40,000 homes every week. "Failure to stem these losses deepens the nation's economic decline," said Adam Kruggel, caravan leader.

"We've come to Washington to advocate for systemic changes that would augment President Obama's recently proposed Helping Families Save Their Homes Act," a mortgage relief effort.

The bus made stops for rallies, petition-signing and picking up additional riders in locations that are particularly hard-hit by the foreclosure crisis -- Denver, Kansas City, Mo., Chicago, Flint, Mich., Camden, N.J. -- and met in Washington March 10 with key congressional leaders, including House Financial Services Chair Barney Frank, and White House officials. Rallies and prayer services highlighted the need for banks and Congress to support plans announced by the federal government to help families stay in their homes.

The petition demands approval of a mortgage relief bill that passed the House on March 5 and an end to lending practices that hurt people, especially the poor and people of color. Obama has proposed this ambitious mortgage relief plan to encourage banks to prevent as many as 3.4 million unnecessary foreclosures.

Most people on board were personal experts on the foreclosure crisis.

Rider Jaime Silahua said he'd just received a 30-day extension before eviction from his home in Pittsburg, Calif., where he and his family have lived since 2002. Silahua, who fell behind on his payments after his teenage son was diagnosed with leukemia in 2007, requested a hardship modification from his lender, U.S. Bank, but was denied because his income fell just short of what he needed to qualify.

Berenice Ramos and her husband, who works as a building contractor, bought their home in Antioch, Calif., in 2005, with a monthly payment of $4,000. When they took out the mortgage they were told they could easily refinance in two years. They never missed a payment. Then in July 2007, the interest rate on their loan reset. Their payment went up $600 per month. They fought for more than a year to modify their loan. "Each 'workout' offer increased our monthly payment by $400. Foreclosure was the only other option offered," Ramos said. In November 2008 they were forced out of their home.

Ramos first put forward the caravan idea, according to Kruggel. "She was in pain from her own loss and witnessing so many others in her neighborhood together with the absolute unwillingness of banks to compromise. Twenty people signed up right away for the trip."

Unless action is taken, an estimated 8 million families nationwide will lose their homes over the next four years, said Kruggel. "We are asking the Treasury to use TARP [Troubled Asset Relief Program] funds to stop preventable foreclosures by adopting a systematic loan modification approach that will result in larger numbers of sustainable modifications. Congress should insure income tax burdens do not undermine the sustainability of loan modifications and lift the ban on judicial loan modifications which would prevent hundreds of thousands of foreclosures without costing the taxpayer at all."

While the causes of the foreclosure crisis are many, the response so far has been focused on voluntary loan modifications. Voluntary efforts by servicers and lenders are dwarfed by the number of new foreclosures, and many of the modifications made so far have not resulted in sustainable loans, according to Kruggel.

One of the first community-based loan modification events in the nation took place at St. Therese Little Flower Parish in Kansas City, Mo., on Jan. 13.

One of the first community-based loan modification events in the nation took place at St. Therese Little Flower Parish in Kansas City, Mo., on Jan. 13.

At a PICO-sponsored rally in California last November, representatives from giant Bank of America and Countrywide Financial Corp., the nation's largest mortgage lending agency, were invited to Kansas City to negotiate loan modifications with local customers. Damon Daniel, a Kansas City organizer from Communities Creating Opportunities (CCO), a PICO affiliate, said none of the 16 who applied got their payment lowered, though some might have their mortgages converted to a fixed-interest rate.

Leslie Kohlmeyer, who was one of 50 people who attended the St. Therese event, said Countrywide told her that since they were $5,000 behind on their payments, after her husband lost his job, their home would be foreclosed. She came to talk first to a loan counselor, then to a representative from Countrywide.

Marian Youngblood of CCO stood up at the California rally and asked Bank of America and Countrywide to come to Kansas City, a locale particularly hard-hit by the foreclosure crisis because of Missouri's lenient laws on predatory lending.

A retired bank loan officer, Youngblood said she knew how banks and mortgage lenders were targeting poor neighborhoods with offers of easy subprime loans and low initial payments that masked adjustable-rate mortgages and interest-only payments that would balloon in a few years far beyond the borrower's ability to pay.

"They would qualify people for loans who were not qualified by falsifying credit scores and inflating appraisals," she said.

It makes good business sense to work with people to keep homes rather than foreclose and attempt to sell the home in a bad market, she said. "Lenders lose 87 cents on the dollar when a home has been foreclosed."

It makes good business sense to work with people to keep homes rather than foreclose and attempt to sell the home in a bad market, she said. "Lenders lose 87 cents on the dollar when a home has been foreclosed."

St. Therese pastor Fr. Ernie Davis characterized the loan modification event as mostly a success. "Nearly everybody who came was relieved to finally be able to speak with somebody. Several people told me they'd been calling and not making any progress.

"The bad news was that even at our event, people were not able to receive on-the-spot modifications. Many will most likely end up losing their homes because the bank does not have a system in place to easily decide who qualities for a loan modification and then make authoritative decisions."

Bolder steps are needed, Davis said, "specifically a systematic nationwide loan modification program that will actually help."

Housing activist Renee Neads said, "There is no single solution that will fix our economy, but tackling one cause of our troubles by slowing the tidal wave of foreclosures is a good start. It is the right thing to do for families and the smart thing to do for the entire community."

Housing activist Renee Neads said, "There is no single solution that will fix our economy, but tackling one cause of our troubles by slowing the tidal wave of foreclosures is a good start. It is the right thing to do for families and the smart thing to do for the entire community."

When the Recovery Express stopped in Kansas City March 7, homeowner Stephanie Zamora told her story at a rally, saying she is at risk of foreclosure. "I represent all of the people who have been shamed by the ugly black mark of foreclosure that are too scared and too proud to admit that they got into a bad situation," she said, adding that she is not asking for a bailout. "What we are asking for is assistance with modifying our loans and holding banks accountable."

"The problem is the greatest sin of our age, which is greed," said Lutheran minister Dale Shotts, a bus rider from Kansas City, referring to predatory lenders. Another rider, the Rev. Lucy Colin from Brentwood, Calif., said, "We've come to tell the story of ordinary people who fight against extraordinary odds."

Rich Heffern is an NCR staff writer. His e-mail address is rheffern@ncronline.org.

How mortgages fall underwater

One in 10 U.S. home mortgages is now either delinquent or in foreclosure, and 13.6 million families owe more on their mortgage than their home is worth. So far, over 3 million families have lost their homes to foreclosure, and another 10 million could do so before the crisis ends. Most at risk are those homeowners who were victims of predatory lending, according to research done by the California-based PICO National Network, a community-organizing group.

Home foreclosures hurt individual homeowners, entire neighborhoods and the whole economy. Housing is at the root of the ongoing financial crisis, which will probably not be overcome until housing prices stabilize. Helping people remain in their homes is the quickest and most compassionate way to promote home price stabilization.

It is estimated that roughly 10 percent of all U.S. home mortgages are now "delinquent" -- meaning that the owner has fallen behind in mortgage payments. A home foreclosure happens when a "mortgage servicer," acting on behalf of lenders who put up the money to finance the loan, determines that a delinquent owner is not going to meet payment obligations in the future. The mortgage servicer then moves to claim what can be salvaged for the lenders by taking possession of the home and attempting to sell it.

Delinquency in mortgage payments can arise for either, or sometimes both, of two reasons: The homeowner is unable to make scheduled mortgage payments because the owner has lost a job or because the monthly payments due have ballooned upward from enticingly low initial payments; or the homeowner is unwilling to make scheduled mortgage payments. This second reason can arise from a situation of "negative equity," meaning that because of unanticipated falling housing prices, a home is worth less than what the homeowner owes on it. In such cases, the homeowner has little economic incentive to keep making mortgage payments and could save money by going delinquent on the payments, undergoing foreclosure and then spending less than the previous monthly mortgage payments on alternative housing.

Estimates suggest that one of every five U.S. home mortgages is now "underwater" -- meaning that the homeowner has negative equity in the home.

-- Rich Heffern

Printed in the March 20 issue of NCR.