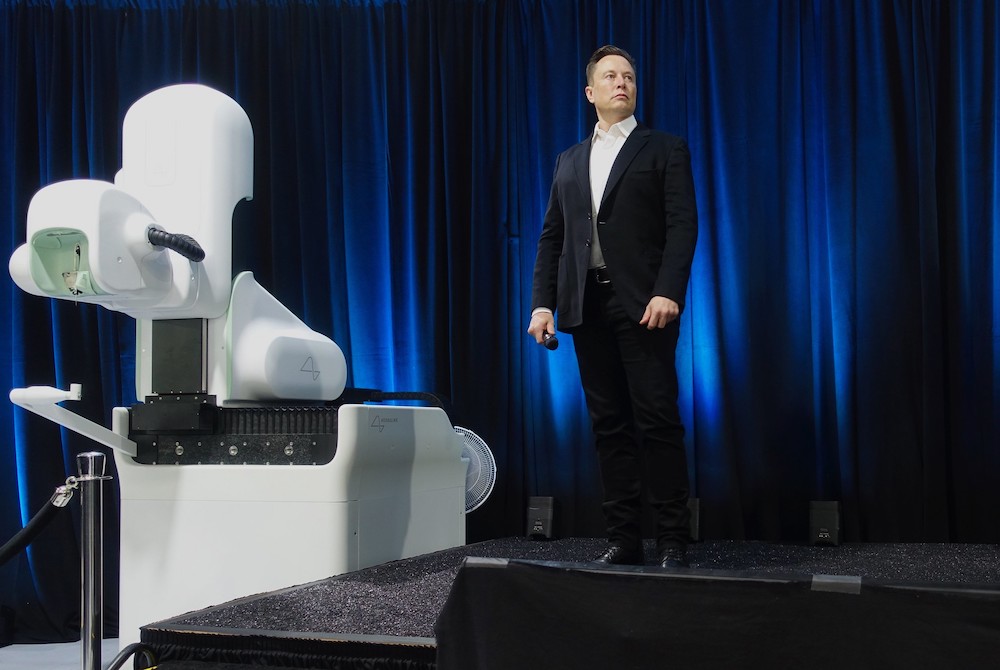

Elon Musk at an update on Neuralink brain implant technology, Aug. 28, 2020 (Flickr/Steve Jurvetson)

Last week, the Bloomberg Billionaires Index announced that Elon Musk had supplanted Jeff Bezos as the world's richest man. As of Jan. 9, his net worth now stands at $209 billion, while poor Mr. Bezos is stuck at a measly $186 billion. Bill Gates is a relative pauper with only $134 billion.

We also know that the corporations that have made these men so wealthy tend not to pay taxes at the rate the rest of us do, if they pay taxes at all. For example, in 2019, Amazon, Bezos' company, paid $162 million in federal taxes for an effective tax rate of 1.2%. And, in previous years, they paid nothing at all. Tesla, Musk's company, has seen its tax bill rise significantly as its profits have risen, and while $110 million in 2019 sounds like a lot, it isn't when you are netting $24.6 billion.

Such news stories make me want to reach for my pitchfork, and I am not the only one.

Populism has a black eye after four years of Donald Trump's iteration of the political approach. In an article at The Atlantic describing populism, its frequently simplistic and nasty attributes are made obvious, but the author, Uri Friedman, obscures the fact that populism's core stance — that the people are not well served by the elite — may be on to something. If liberals leave the populist instinct to conservatives, we can expect Trumpism to be back.

It is also clear what a liberal populism should focus on: narrowing economic inequality. In this new gilded age, as in the 19th century version, the excesses of the wealthy are a standing invitation to the working class to anger and resentment. Trump has stoked that resentment and focused it on those, like immigrants, who are not responsible for the plight of the working class. Liberals need to refocus the resentment on the wealthy who rig the system and continue to line their already full pockets.

President-elect Joe Biden is well advised to start his presidency with proposals that could be described as liberal populist, ideas that will make it very difficult for Republicans to oppose lest they appear like shills for the uber rich. One such proposal is for an alternative minimum corporate tax.

Advertisement

The Alternative Minimum Tax, which applies to individuals, has been on the books since 1969. The IRS explains its purpose thus: "Under the tax law, certain tax benefits can significantly reduce a taxpayer's regular tax amount. The alternative minimum tax (AMT) applies to taxpayers with high economic income by setting a limit on those benefits. It helps to ensure that those taxpayers pay at least a minimum amount of tax."

The Trump administration and congressional Republicans succeeded in passing significant changes to the Alternative Minimum Tax as part of their tax reform in 2017. They increased the amount of money exempt from the tax, as well as lowered the rate. Both before and after the reform, the tax only affected rich people, those making between $200,000 and half a million dollars. About 3% of taxpayers paid the tax before the Trump reforms, and only about 0.1% pay it now.

An alternative minimum corporate tax has the same rationale but would be even easier to enact politically than a restoration of the pre-Trump alternative minimum tax for individuals.

Most tax cuts are designed by those corporations with enough money to hire an army of lobbyists to get the cut inserted into the tax code, and another army of tax lawyers and accounts to harvest the cut year in and year out. Small businesspeople do not have that kind of juice, so when they read about Amazon paying nothing or next to nothing, they get enraged too.

This robs the GOP of one of its most common attacks on Democrats, that they are a bunch of anti-business socialists. I do not doubt that soon-to-be Senate Minority Leader Mitch McConnell (does that have a ring to it, or what?) will oppose this, but he will have a hard time crafting a political defense for his opposition.

I will leave it to the economists to decide what the rate should be and to the politicians to decide whether or not to target the new revenue for infrastructure, education or general revenue.

Will this proposal cause the working class to abandon Trump? Of course not. Even if Democrats enact policies that actually help the working class, it only takes a stray comment like Hillary Clinton's "deplorables" or Anderson Cooper's dissing of the Olive Garden to remind millions of Americans that many among the coastal elites really do look down on them as rubes. As Maya Angelou is commonly attributed as having said: "I've learned that people will forget what you said, people will forget what you did, but people will never forget how you made them feel."

Populist liberal policies like an alternative minimum corporate tax, however, might convince some percentage of working-class voters to stop demonizing Democrats, to recognize that populist liberal policies really might increase opportunities in life for them and their children. Liberals may be godless socialists and politically correct snobs, but if they make the economy fairer and use the proceeds to improve local schools or to provide high speed internet in rural areas, they can't be all bad!

Most of those involved in the transition are busy figuring out whom to appoint to which post, but I hope some of the leadership is thinking about enacting policies to help build a governing coalition that will last. The country is in desperate straits, and it is not enough to do the kinds of things Democrats always do. We need to help heal our democracy. Finding ways to redirect populist anger, much of it justified, should be a sine qua non for the Biden-Harris administration.