A Citibank office in New York is shown in this Wednesday, Jan. 13, 2021, file photo. Citigroup reported earnings on Friday, April 14. (AP photo/Mark Lennihan, File)

More than 31% of Citigroup shareholders supported a resolution brought by Catholic congregations that called for a review of the global bank's financing policies around climate change and Indigenous rights after Citigroup pumped billions of dollars into oil pipeline companies in recent years.

The vote took place April 25 during Citigroup's annual general meeting. A similar resolution drew roughly the same support last year, when 33% of shareholders voted in its favor. While shareholder resolutions are legally non-binding, companies typically respond in some way to measures that garner more than 20% support.

The resolution at Citigroup called for the bank, one of the top financiers of fossil fuels worldwide, to produce a report reviewing the effectiveness of its policies and practices in adhering to international standards for Indigenous rights and financial industry benchmarks it helped draft for assessing environmental and social risks in project funding.

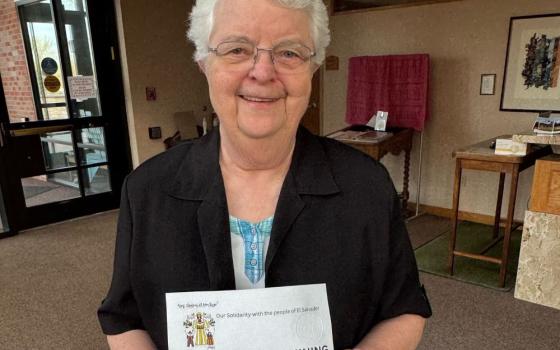

The resolution was brought by the Sisters of St. Joseph of Peace; the Sisters of St. Dominic of Caldwell, New Jersey; the Sisters of St. Francis of Philadelphia; and United Church Funds, the institutional investment ministry of the United Church of Christ. It was supported by Investor Advocates for Social Justice, a coalition of predominantly Catholic congregations.

While hoping for higher support this year, Sr. Susan Francois, treasurer for the Sisters of St. Joseph of Peace, which acted as the lead filers, said it was not a totally surprising result given Citigroup's disagreement with the resolution in its proxy statement.

"We will be back," she told EarthBeat. "We're committed to engaging with Citigroup on this," Francois added, while expressing optimism that its board would reenter into dialogue with them after talks broke down following last year's resolution vote.

"It's an issue of critical importance for both Earth and for Indigenous rights," she said.

The vote was one of several held Tuesday (April 25) during shareholder meetings at major banks, with more to come later in the week. On Monday, climate activists demonstrated by holding sit-ins at banks across the U.S., including Citigroup headquarters in New York City.

Advertisement

Along with targeting fossil fuel companies, such as through global divestment campaigns, climate activists have increasingly focused attention on the financial sector that provides the capital for new mining and drilling for coal, oil and gas around the globe.

In order to meet the Paris Agreement's more ambitious goal of limiting average temperature rise to 1.5 degrees Celsius — which climate scientists say remains possible, though the window is narrowing fast — the world must stop investing in new fossil fuel projects, the International Energy Agency determined in a May 2021 report.

Overall, the world's 60 largest banks have injected $5.5 trillion into the fossil fuel industry in the past seven years, according to an April report issued by Rainforest Action Network, Sierra Club and other environmental groups. At $332 billion, Citigroup ranks second in total fossil fuel financing, behind JP Morgan Chase, and has provided $113.5 billion toward expanding the use of the polluting fuel sources.

At the center of the Catholic sisters' shareholder resolution with Citigroup was more than $5 billion in financing that the bank has provided to Enbridge, a Canadian fossil fuel company and one of the largest pipeline builders in the world with a long history of oil spills. Recently, its Line 3 and Line 5 pipeline replacement projects in the Great Lakes region have drawn strong opposition from Indigenous communities, environmentalists and even some government officials.

The resolution argued that financing Enbridge was at odds with Citigroup's various commitments to respect and uphold Indigenous rights in projects it finances, as well as the bank's own public climate pledges. The bank has said its current environmental and social risk policy is working to identify potential investment pitfalls, and that it provided Enbridge with general financing, not project-specific financing that triggers the screens — a defense the sisters say minimizes its role in funding fossil fuel projects like Line 3 and Line 5.

A separate resolution called for Citigroup to cease financing to fossil fuel companies for new coal, oil and gas projects, with roughly 10% of shareholders voting in favor, a total also lower than the previous year.

Francois told EarthBeat it was important that Citi shareholders heard directly from Indigenous leaders through their resolution. Tara Houska, founder of the Giniw Collective that led opposition against Line 3, presented the resolution at the meetings.

"Indigenous peoples hold 80% of earth's remaining biodiversity — we are the canary in the mine of humanity," Houska said in a statement. "[Citigroup's] big oil clients are destroying our homelands and lifeways as they tout empty policies and procedures. For our children’s sake and yours, hear our voices: humans cannot live without water, humans cannot endlessly extract without consequence."

Citigroup was one of three major banks to hold shareholder meetings on Tuesday. Wells Fargo and Bank of America also faced votes on resolutions calling for the financial institutions to end financing for new fossil fuel projects. At Bank of America, just 7% of shareholders supported the measure, less than the year before, and Wells Fargo shareholders also rejected the motion, though specific tallies were not released, Reuters reported. A separate resolution at Bank of America drew 28.5% support for an action plan to be created to meet the bank's 2030 net-zero emissions goals.

Other climate-related resolutions were on the docket at Goldman Sachs on Wednesday and with BP on Thursday.

Francois said that consumers have a political responsibility to use their economic power and influence "to support the common good, because that's really what good business is."

Beyond companies' bottom lines, "we have a fiduciary responsibility to Earth and to future generations. And that's clear in the resolution season this year, and I have a feeling next year will be even more coordinated and moving us in the right direction."