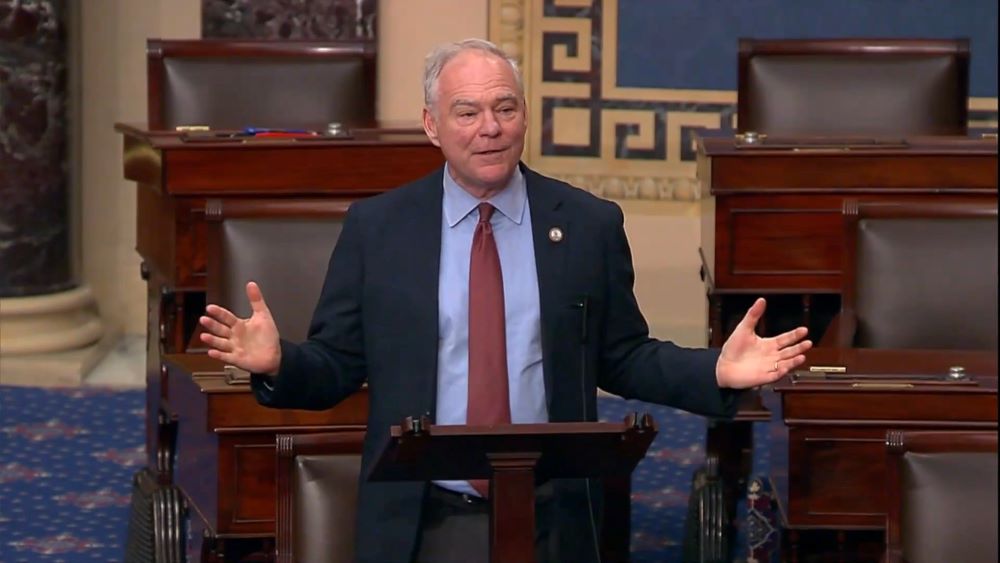

U.S. Senator Tim Kaine, Democrat of Virginia, a Catholic and a member of the Senate Budget Committee, speaks on the Senate floor April 4 about his strong opposition to the Republicans' budget plan. The tax bill passed by a slim margin, mostly along party lines, 51-48. (Tim Kane U.S. Senate website)

It is cherry blossom season in Washington. For about a week or so, the blooms on the famed Japanese cherry trees on the Tidal Basin draw scores of people to admire a gift from God, an array of pink dots on the background of cool, dark waters. It is a fleeting moment of beauty in a town of deception and dark motives.

As the blooms flew off the Yoshinos, a battle was underway in the war taking shape over tax codes, budgets and the fundamental priorities of our nation. These are the quiet levers of power that decide who eats and who is left behind, who flourishes, and who falls deeper into poverty.

The battle took place at the other end of the National Mall, where the U.S. Senate met into the early hours of April 5 to pass a heartless budget framework, by the slimmest of margins, 51-48, using a political trick called reconciliation. This is a device the majority Republicans used to pass by simple majority a controversial and divisive budget reconciliation bill that would never succeed under the usual Senate procedures.

The GOP budget framework contains is a reverse-Robin Hood style tax scheme in which, once again, the ghosts of past tax cuts return, cloaked in campaign promises and political slogans. Trump-era tax cuts — sold in 2017 as "relief" and "growth" — are back, this time with ambitions to go further, deeper and more enduring.

There is no Gospel logic in this. This is not justice.

Let us be plain: What is being proposed is not tax reform. It is not aimed at fairness, economic stability or the public good. It is a redistribution of wealth — upward, deliberate and vast, from the poorest of the poor to the richest of the rich. And more than just poor policy, it is a profound moral failure. These proposals violate the very heart of Catholic social teaching.

They strip dignity from the poor, reward the wealthy and undermine the foundations of a just society. This is not merely political. It is spiritual. It is ethical. The central question: Will our economy serve the many or the few?

Catholic teaching is clear: Every economic decision is a moral one. The Catechism of the Catholic Church reminds us that "the demands of justice must be satisfied first; that which is already due in justice is not to be offered as a gift of charity." In every policy decision, the preferential option for the poor demands that we ask: Who benefits and who suffers? And what do the proposed tax cuts say about the soul of our nation?

The 2017 Tax Cuts and Jobs Act, which Trump vows to revive and entrench, was sold as a benefit for working families. But according to the Institute on Taxation and Economic Policy, in 2026 the poorest Americans, those earning less than $28,600 a year, would see less than $800 in tax cuts. Americans with incomes of $914,900 and above, on the other hand, would receive an average tax cut of about $36,300

There is no Gospel logic in this. This is not justice. It is, as Pope Francis has called it, an "economy of exclusion and inequality." An economy that "kills."

The Trump plan proposes to make permanent several of the tax-scheme provisions that are even more skewed in favor of the wealthy: lower income tax rates, a weakened alternative minimum tax, elimination of the estate tax and continuation of the 20% deduction for pass-through business income.

The cost? A deficit-exploding price tag of more than $4 trillion over the next decade. That is $4 trillion not going to housing, education, environmental repair, veterans' care or children's nutrition. The catechism teaches that "political authority has the right and duty to regulate the legitimate exercise of the right to ownership for the sake of the common good." This plan does the opposite.

Some overrated parts of the plan have a deceptively appealing allure for working people. Trump and his allies have floated proposals to exempt tips, overtime pay and Social Security income from taxation. However, these are pennies in the tin cups of the poor.

Trump has already axed programs like SNAP (the Supplemental Nutrition Assistance Program), Medicaid, housing assistance and education. He has terminated more than 5,300 U.S. Agency for International Development grants and contracts worth over $27 billion.

In West Virginia, a dairy farmer named Trey Yates lost his contract with food banks when the administration cut funding to the Local Food Purchase Assistance Cooperative Agreement Program, a $500 million initiative. That contract had sustained his small farm. It ended. So did a lifeline.

The so-called Department of Government Efficiency (DOGE), with Trump’s top campaign contributor, Elon Musk, at the helm, claims to ax federal programs "to root out waste." And, so, in the name of ending "fraud," it has cut tens of thousands of jobs from health-related federal agencies with many more staff reductions to come while undermining critical social programs, including Social Security, Medicare, Medicaid and veterans' services. The fraud starts with those enacting the cuts.

Advertisement

Catholic teaching does not insist on big government. But it insists on a just and competent government. Or, to paraphrase Dorothy Day, going along with this reverse Robin Hood proposal would mean cooperation with a "filthy, rotten system."

One senator very familiar with Catholic teaching is Sen. Tim Kaine, Democrat of Virginia, who was trained by Jesuits, served in the Jesuit Volunteer Corp and sings in the choir of his Catholic parish in Richmond. During the Senate debate, he said the tax scheme would be paid for by the "economic idiocy" of the Trump import taxes (tariffs) and on the backs of the poor. "They'll combine the tariff revenue with the savings from Medicaid cuts or cuts to school nutrition or cuts to the Pell Grant program, and then they will take all of that revenue and hand it over to the richest people in this country," Kaine said, "many of whom are the richest people on the Planet Earth."

The debate now goes to the House, where the tax-scheme faces resistance from some House Republicans and its fate is unsure. The few Republicans are right to share Democratic skepticism. This is not a routine debate. It is a referendum on moral clarity. It is a moment for the church to speak with courage. Christ stood with the poor. He warned against storing up treasure while others starve. "Whatever you did for one of the least of these," Jesus said, "you did for me." We are called to no less.